PROPERTY TAX

Making property tax management a breeze.

It's possible.

total properties assessed

revenue collections to date

collections in 2021-22

For the Citizens

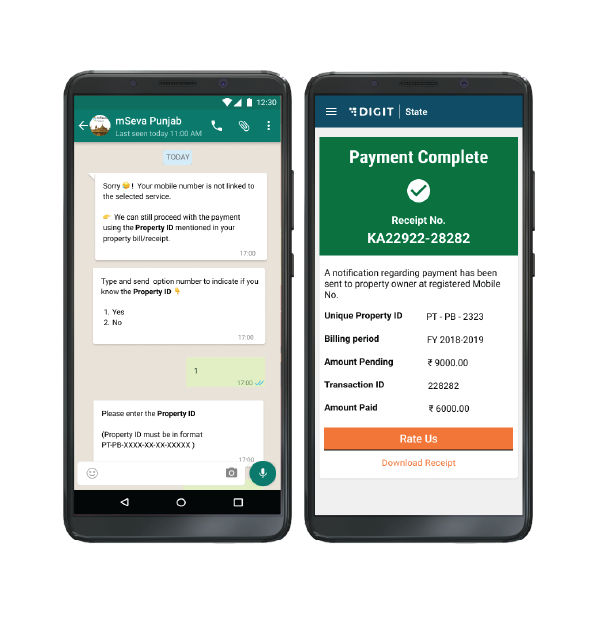

Easy self-serve

DIGIT-Property Tax (PT) is a self-serve facility for citizens that provides easy tax assessment and payment services to citizens in real-time.

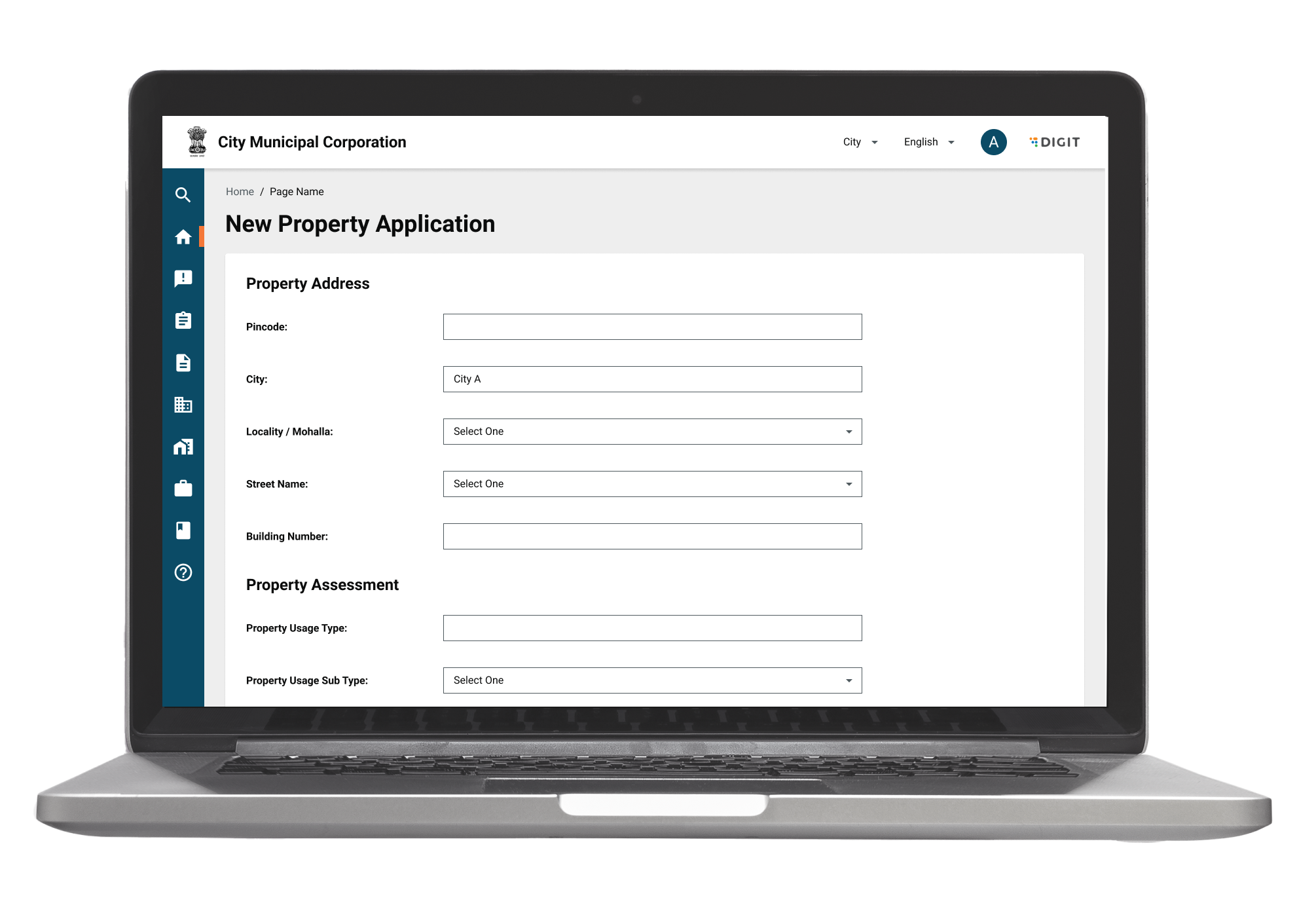

Self-assess property

Citizens can perform self-assessment of a new property for a financial year.

Mutation of property

Perform mutation or transfer of ownership of property details.

Automate tax calculation

Configure the system to auto-compute property taxes as per the State regulations and defined procedures.

For the Urban Local Bodies

Easy automation

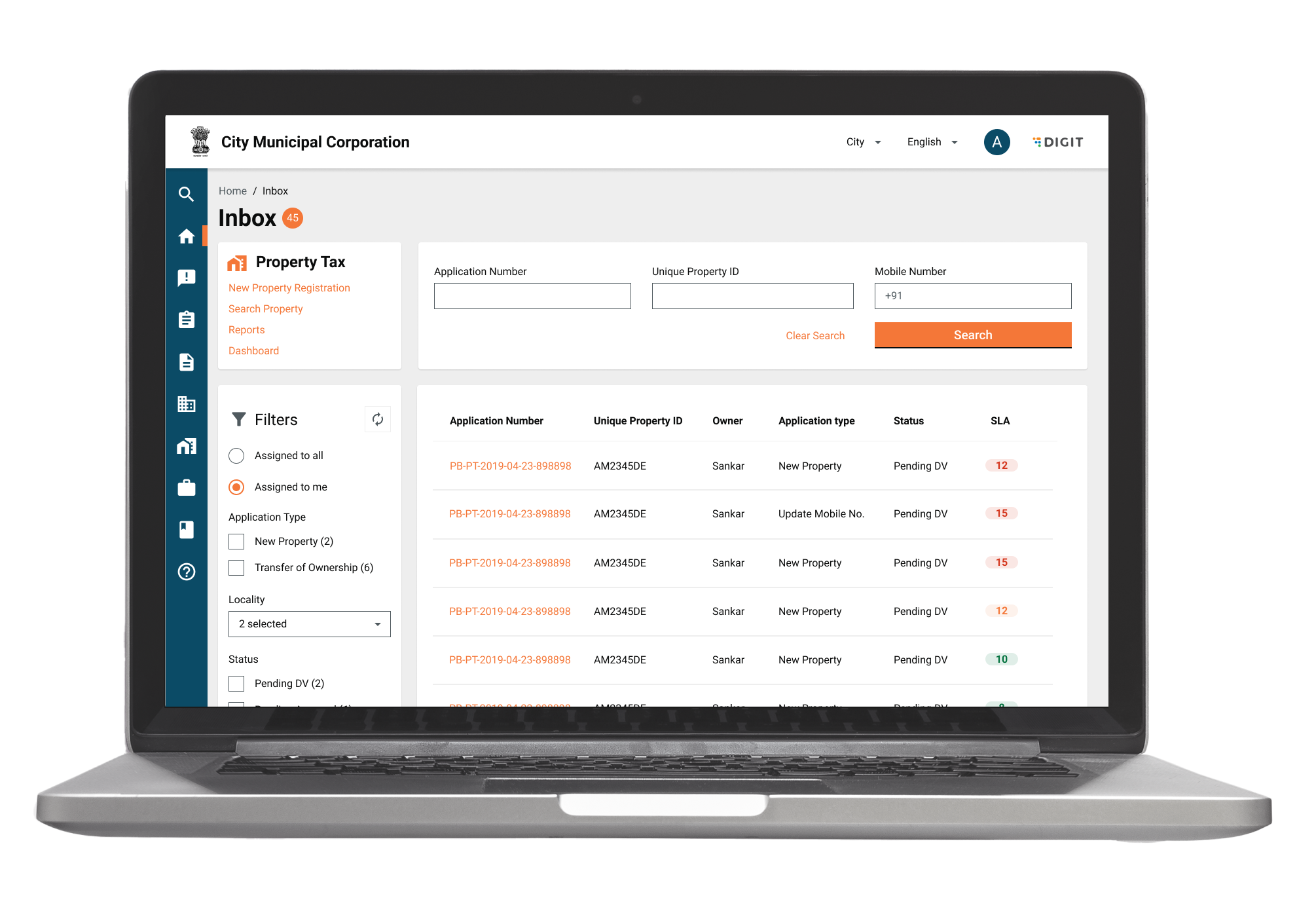

DIGIT-Property Tax (PT) addresses the objectives of municipal corporations and local governments to automate all property tax operations

Manage Property Tax

Register, self-assess properties. Process property mutation, alteration, bifurcation and amalgamation.

Generate demand notice

Generate automated demand notice and auto-push notifications for payments

Migrate Legacy Data

Migrate legacy data of existing properties and of demand and collection details